New Jersey Real Estate Transfer Tax Forms . the state imposes a realty transfer fee (rtf) on the seller of real property for recording a deed for the sale. — the new jersey department of taxation mandates a realty transfer fee (rtf) to be paid by sellers when recording. — a git/rep form is a gross income tax form required to be recorded with a deed when real property is. this calculator provides an estimate of the realty transfer fee (rtf) that you will need to pay when you sell real property in new jersey. — this page provides links for assistance with regard to the git/rep, realty transfer fee (rtf), controlling interest. — the primary additional step a person must undergo to close on the sale of a property in new jersey when they are not a resident is pay a non.

from www.pdffiller.com

— a git/rep form is a gross income tax form required to be recorded with a deed when real property is. the state imposes a realty transfer fee (rtf) on the seller of real property for recording a deed for the sale. — the new jersey department of taxation mandates a realty transfer fee (rtf) to be paid by sellers when recording. this calculator provides an estimate of the realty transfer fee (rtf) that you will need to pay when you sell real property in new jersey. — the primary additional step a person must undergo to close on the sale of a property in new jersey when they are not a resident is pay a non. — this page provides links for assistance with regard to the git/rep, realty transfer fee (rtf), controlling interest.

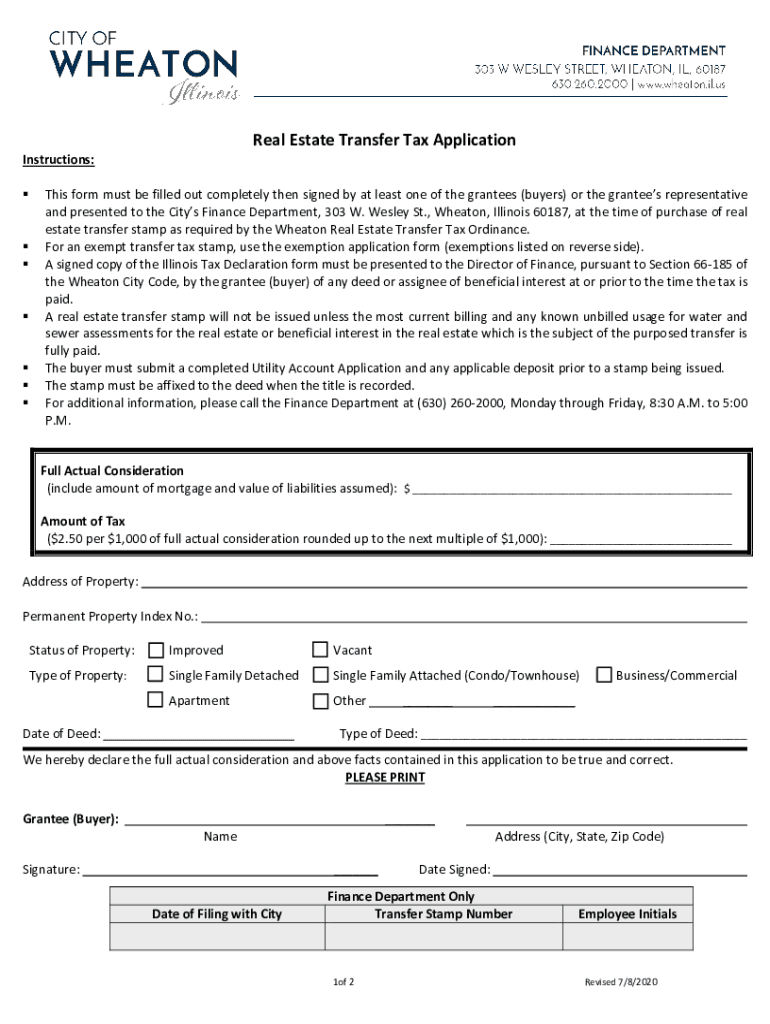

Fillable Online wheaton il Real Estate Transfer Tax Application Form

New Jersey Real Estate Transfer Tax Forms the state imposes a realty transfer fee (rtf) on the seller of real property for recording a deed for the sale. — the new jersey department of taxation mandates a realty transfer fee (rtf) to be paid by sellers when recording. — this page provides links for assistance with regard to the git/rep, realty transfer fee (rtf), controlling interest. the state imposes a realty transfer fee (rtf) on the seller of real property for recording a deed for the sale. — the primary additional step a person must undergo to close on the sale of a property in new jersey when they are not a resident is pay a non. this calculator provides an estimate of the realty transfer fee (rtf) that you will need to pay when you sell real property in new jersey. — a git/rep form is a gross income tax form required to be recorded with a deed when real property is.

From www.sampleforms.com

FREE 43+ Sample Transfer Forms in PDF Ms Word Excel New Jersey Real Estate Transfer Tax Forms the state imposes a realty transfer fee (rtf) on the seller of real property for recording a deed for the sale. — the new jersey department of taxation mandates a realty transfer fee (rtf) to be paid by sellers when recording. — a git/rep form is a gross income tax form required to be recorded with a. New Jersey Real Estate Transfer Tax Forms.

From www.theoldfathergroup.com

Real Estate Transfer Tax What Are They & Where Does The Money Go New Jersey Real Estate Transfer Tax Forms — the new jersey department of taxation mandates a realty transfer fee (rtf) to be paid by sellers when recording. — the primary additional step a person must undergo to close on the sale of a property in new jersey when they are not a resident is pay a non. this calculator provides an estimate of the. New Jersey Real Estate Transfer Tax Forms.

From www.templateroller.com

Form RTF3 Download Fillable PDF or Fill Online Claim for Refund New Jersey Real Estate Transfer Tax Forms this calculator provides an estimate of the realty transfer fee (rtf) that you will need to pay when you sell real property in new jersey. — this page provides links for assistance with regard to the git/rep, realty transfer fee (rtf), controlling interest. — the primary additional step a person must undergo to close on the sale. New Jersey Real Estate Transfer Tax Forms.

From dxoluqmio.blob.core.windows.net

Real Estate Transfers Charleston Sc at Michael Hilson blog New Jersey Real Estate Transfer Tax Forms — the primary additional step a person must undergo to close on the sale of a property in new jersey when they are not a resident is pay a non. — the new jersey department of taxation mandates a realty transfer fee (rtf) to be paid by sellers when recording. — a git/rep form is a gross. New Jersey Real Estate Transfer Tax Forms.

From www.formsbank.com

Oak Lawn Real Estate Transfer Tax Form printable pdf download New Jersey Real Estate Transfer Tax Forms — a git/rep form is a gross income tax form required to be recorded with a deed when real property is. — the primary additional step a person must undergo to close on the sale of a property in new jersey when they are not a resident is pay a non. — the new jersey department of. New Jersey Real Estate Transfer Tax Forms.

From www.uslegalforms.com

New Hampshire Real Estate Transfer Tax Statement of Consideration Nh New Jersey Real Estate Transfer Tax Forms — the primary additional step a person must undergo to close on the sale of a property in new jersey when they are not a resident is pay a non. this calculator provides an estimate of the realty transfer fee (rtf) that you will need to pay when you sell real property in new jersey. — the. New Jersey Real Estate Transfer Tax Forms.

From www.formsbank.com

Form 2719 Return For Real Estate Transfer Tax printable pdf download New Jersey Real Estate Transfer Tax Forms — a git/rep form is a gross income tax form required to be recorded with a deed when real property is. — the primary additional step a person must undergo to close on the sale of a property in new jersey when they are not a resident is pay a non. — this page provides links for. New Jersey Real Estate Transfer Tax Forms.

From www.formsbank.com

Fillable Form 82127 Philadelphia Real Estate Transfer Tax New Jersey Real Estate Transfer Tax Forms the state imposes a realty transfer fee (rtf) on the seller of real property for recording a deed for the sale. — a git/rep form is a gross income tax form required to be recorded with a deed when real property is. this calculator provides an estimate of the realty transfer fee (rtf) that you will need. New Jersey Real Estate Transfer Tax Forms.

From www.pdffiller.com

Fillable Online wheaton il Real Estate Transfer Tax Application Form New Jersey Real Estate Transfer Tax Forms the state imposes a realty transfer fee (rtf) on the seller of real property for recording a deed for the sale. — the new jersey department of taxation mandates a realty transfer fee (rtf) to be paid by sellers when recording. — the primary additional step a person must undergo to close on the sale of a. New Jersey Real Estate Transfer Tax Forms.

From dailyhive.com

Foreign buyers only account for 5 Metro Vancouver real estate sales New Jersey Real Estate Transfer Tax Forms — the new jersey department of taxation mandates a realty transfer fee (rtf) to be paid by sellers when recording. — the primary additional step a person must undergo to close on the sale of a property in new jersey when they are not a resident is pay a non. the state imposes a realty transfer fee. New Jersey Real Estate Transfer Tax Forms.

From www.uslegalforms.com

New York State Combined Transfer Tax Return and Credit Line Mortgage New Jersey Real Estate Transfer Tax Forms — the new jersey department of taxation mandates a realty transfer fee (rtf) to be paid by sellers when recording. — this page provides links for assistance with regard to the git/rep, realty transfer fee (rtf), controlling interest. this calculator provides an estimate of the realty transfer fee (rtf) that you will need to pay when you. New Jersey Real Estate Transfer Tax Forms.

From curbelolaw.com

New Jersey realty transfer fee 2024 guidelines Curbelo Law New Jersey Real Estate Transfer Tax Forms — the new jersey department of taxation mandates a realty transfer fee (rtf) to be paid by sellers when recording. the state imposes a realty transfer fee (rtf) on the seller of real property for recording a deed for the sale. — the primary additional step a person must undergo to close on the sale of a. New Jersey Real Estate Transfer Tax Forms.

From www.formsbirds.com

Claim for Refund Realty Transfer Fee New Jersey Free Download New Jersey Real Estate Transfer Tax Forms the state imposes a realty transfer fee (rtf) on the seller of real property for recording a deed for the sale. this calculator provides an estimate of the realty transfer fee (rtf) that you will need to pay when you sell real property in new jersey. — a git/rep form is a gross income tax form required. New Jersey Real Estate Transfer Tax Forms.

From www.formsbirds.com

Combined Real Estate Transfer Tax Return Form Free Download New Jersey Real Estate Transfer Tax Forms — the primary additional step a person must undergo to close on the sale of a property in new jersey when they are not a resident is pay a non. — a git/rep form is a gross income tax form required to be recorded with a deed when real property is. — this page provides links for. New Jersey Real Estate Transfer Tax Forms.

From www.dochub.com

Maine real estate tax Fill out & sign online DocHub New Jersey Real Estate Transfer Tax Forms — this page provides links for assistance with regard to the git/rep, realty transfer fee (rtf), controlling interest. — the primary additional step a person must undergo to close on the sale of a property in new jersey when they are not a resident is pay a non. the state imposes a realty transfer fee (rtf) on. New Jersey Real Estate Transfer Tax Forms.

From www.formsbirds.com

Assets Transfer Tax Declaration New Jersey Free Download New Jersey Real Estate Transfer Tax Forms this calculator provides an estimate of the realty transfer fee (rtf) that you will need to pay when you sell real property in new jersey. the state imposes a realty transfer fee (rtf) on the seller of real property for recording a deed for the sale. — the new jersey department of taxation mandates a realty transfer. New Jersey Real Estate Transfer Tax Forms.

From www.formsbirds.com

Combined Real Estate Transfer Tax Return Form Free Download New Jersey Real Estate Transfer Tax Forms the state imposes a realty transfer fee (rtf) on the seller of real property for recording a deed for the sale. — this page provides links for assistance with regard to the git/rep, realty transfer fee (rtf), controlling interest. — a git/rep form is a gross income tax form required to be recorded with a deed when. New Jersey Real Estate Transfer Tax Forms.

From www.signnow.com

Real Estate Transfer Tax Return Fast and secure airSlate SignNow New Jersey Real Estate Transfer Tax Forms — the primary additional step a person must undergo to close on the sale of a property in new jersey when they are not a resident is pay a non. — the new jersey department of taxation mandates a realty transfer fee (rtf) to be paid by sellers when recording. this calculator provides an estimate of the. New Jersey Real Estate Transfer Tax Forms.